VA Loans

What are VA Loans?

A VA loan is a type of mortgage backed by the US Department of Veterans Affairs. VA loans are designed to help active-duty military and veterans achieve the American dream of homeownership. Started in 1944, it helps them buy homes with favorable terms. These loans have lower interest rates than regular ones. They’re only available to service members and some military spouses. Private lenders like banks issue VA loans but are guaranteed by the VA against default. The guarantee covers up to a quarter of the loan amount. In 2024, the maximum loan amount is $766,550. VA loans can also be used to refinance existing mortgages. They’re popular among first-time homebuyers in the military due to their great benefits.

VA Loan Benefits

- No down payment is required: Servicemembers can own a home without saving for a down payment.

- Lower interest rates: VA loans offer lower interest rates compared to conventional loans.

- No monthly mortgage insurance premiums: With a VA loan, you won't pay monthly

- No prepayment penalty: You can sell or refinance without penalties, though cash-out refinances have different rules.

- Reduced funding fees: You might get reduced fees or exemptions for service-connected disability compensation.

- Ability to finance the funding fee: The funding fee can be included in the loan amount.

- Less than perfect credit usually accepted: You don't need perfect credit for a VA loan.

- Up to 100% Cash-Out Refinance: Use your home's value to get cash for various purposes.

- VA assistance for financial difficulties: Borrowers facing certain financial difficulties can get help from the VA.

What are the VA Loan Requirements?

The United States Department of Veteran Affairs lists many eligibility requirements for a VA home loan. The borrower must possess a Certificate of Eligibility (COE), decent credit, and a steady income.

The COE can be received if an active-duty soldier has been honorably discharged and has completed at least two service requirements. These requirements include qualifying wartime and peacetime periods, active duty dates, and minimum service.

VA Loan Eligibility:

- 90 days of service during wartime.

- 181 continuous days of active service during peacetime.

- 6 or more years of service in the National Guard or Reserves.

- Being the un-remarried, surviving spouse of a servicemember who died in the line of duty, or as a result of a service-related disability

Additional Requirements for VA Loans:

- Payment of a Funding Fee: Varies based on down payment and military category.

- Move-in requirement: Within 60 days of purchase, with exceptions in some cases.

- Usage restriction: Must be for a primary residence; cannot be used for investment or second homes

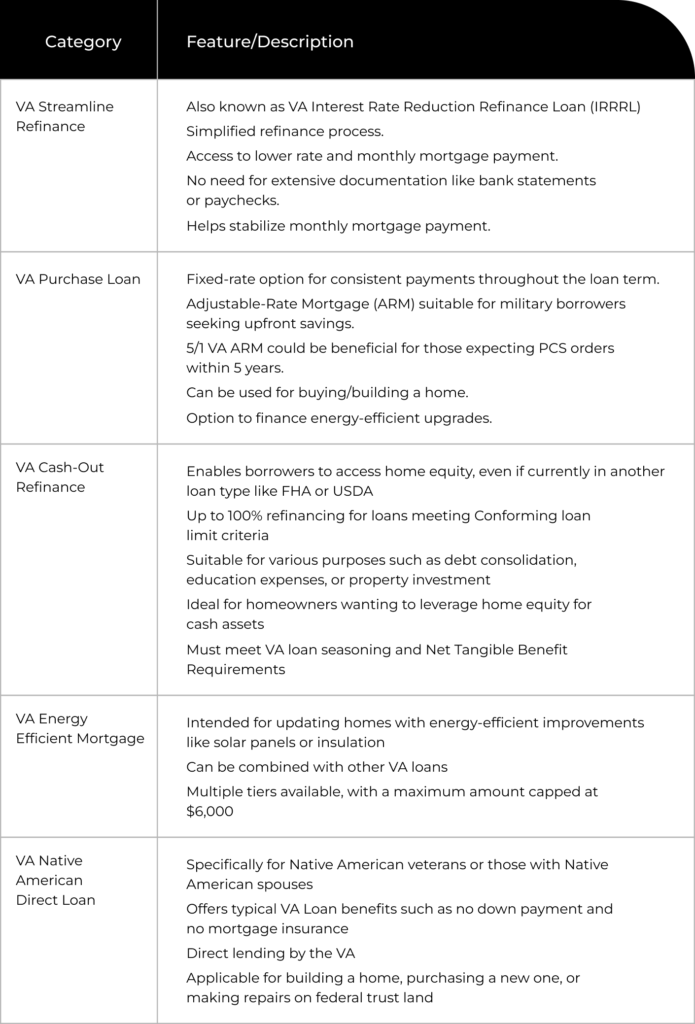

Types of VA Loans

FAQ

A VA loan is a mortgage backed by the U.S. Department of Veterans Affairs. Va Loan is available to eligible veterans and service members,

There are numerous benefits of VA Loan including no down payment, no private mortgage insurance (PMI), and competitive interest rates.

Eligible veterans, active-duty service members, and some members of the National Guard and Reserves.

VA loans are primarily for primary residences, but in some cases, you can use a VA loan for a second home.