Conventional Loans

What are Conventional Loans?

Conventional loans are mortgage loans that are not government-insured (such as FHA, VA, or USDA loans), but they typically adhere to the lending rules established by Fannie Mae or Freddie Mac. Conventional loans generally offer better terms, rates, and are usually cheaper than other types of loans. However, conventional loans often require an applicant to have good-to-excellent credit, manageable monthly debt responsibilities, a 5-20% down payment, and consistent monthly income. Conventional loans are best suited for borrowers with excellent credit and a minimum of a 5% down payment.

Conventional Loan Benefits

- Fewer limitations compared to government-backed loans.

- No upfront mortgage insurance is required.

- After achieving 20% equity, you can discontinue your private mortgage insurance (PMI). If the property is the borrower's primary or secondary residence, and the borrower has an acceptable payment record, the borrower has to request mortgage insurance termination based on the property's original valuation.

- Higher credit scores may result in a reduced interest rate.

- Less strict appraisals and property standards than FHA, VA, or USDA mortgages.

- Faster Loan processing.

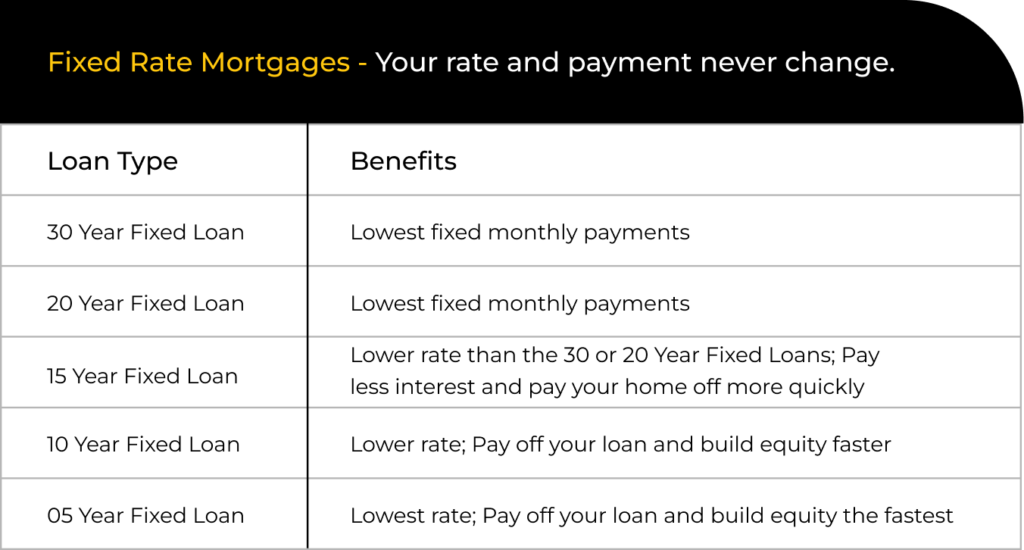

- Term durations can vary from 10 to 30 years.

What are the Conventional Down Payment Requirements?

There are some general conditions for all conventional loans, whether they are conforming or non-conforming.

You will need to fill out a mortgage loan application and pay any necessary costs before having your credit report performed. The credit report will review your credit history and calculate your credit score. You must also provide supporting documents.

The general requirements for a conventional loan are below:

- Proof of income

- Pay stubs .

- Two years of federal tax returns

- Two years of W-2 statements, etc.

- Asset accounting

- Bank statements

- Investments to cover down payment and closing costs

- Employment verification indicating stable work history

- Miscellaneous documents

- Driver’s license or state identification card

- Social Security number

- Minimum credit score: 620

- Down payment

- 3% to 20% depending on credit and income circumstances

- Debt-to-income ratio: ≤ 43%

- Some flexibility with higher DTI under certain conditions

- Qualification challenges if

- Credit score is well below 620

- DTI exceeds 43%

- Down payment is significantly less than 20%

- Bankruptcy or foreclosure within the last seven years

Types of conventional loans

What types of property are eligible?

Most conventional loan programs allow you to purchase single-family homes, warrantable condos, planned unit developments, and 1-4 family residences. A conventional loan can also be used to finance a primary residence, second home, and investment property.

FAQ

You can refinance from an FHA to a Conventional loan once you attain 20% equity in your home. This switch offers several advantages. It can decrease your monthly mortgage payments by reducing the interest rate and eliminating mandatory mortgage insurance on FHA loans. However, remember that FHA and conventional loans differ in credit requirements, potentially affecting your eligibility for a conventional loan. When contemplating refinancing, factor in future home prices and mortgage rates. Assess both costs and benefits, as refinancing incurs closing fees, payable upfront or added to the loan. Explore options using our mortgage refinance calculator or our FHA vs. Conventional loans blog. Our Loan Officers are also available for guidance and queries.

Yes, you can receive down payment assistance with a Conventional loan. Eligibility hinges on various factors. Typically, assistance prioritizes first-time homebuyers, defined as those without homeownership in over 3 years. Individuals with rental or investment properties may not qualify. Programs primarily operate locally, each with distinct criteria. Lenders impose additional requirements and may limit assistance application. Researching local and state options is necessary to find suitable assistance. Discussing available options with your lender is advisable to navigate the process effectively.

Conventional loan mortgages do not demand a 20% down payment, however doing so does eliminate the requirement for Private Mortgage Insurance (PMI). Conventional mortgages normally need a 3% down payment, however this amount might vary depending on the borrower’s credit score, loan-to-value ratio, credit history, and debt-to-income ratio.