FHA Loans

What are FHA Loans?

FHA loans are a popular choice for homebuyers because they’re insured by the Federal Housing Administration. This makes it easier for first-time buyers and those with less-than-perfect credit to qualify for a mortgage. At United 1 Mortgage Corporation, we specialize in FHA loans and can guide you through the process. Here’s how it works: The FHA doesn’t lend money directly; instead, they insure the loan, making you a less risky borrower. We’ll ensure you meet the FHA’s requirements and structure the loan accordingly. Explore our FHA loan center for more information and visit the official Housing and Urban Development website for additional resources.

FHA Loan Benefits

- Backed by the federal government, making lenders more likely to approve your loan.

- Requires only a 3.5% down payment, facilitating homeownership.

- Allows the down payment to come in the form of gifts, unlike other loan programs.

- Higher credit scores may result in a reduced interest rate.

- Government backing makes it easier for those with a poor credit history to qualify.

- Government backing typically results in better interest rates compared to traditional mortgages.

- FHA offers programs to assist homeowners in keeping their homes during tough times.

- Collaborates with homeowners to prevent foreclosure by resolving issues with lenders early on.

What are the FHA Loan Requirements?

When you apply for an FHA loan, the following list of documents will help expedite the process. We can help you understand any part of the FHA loan process, so don’t hesitate to contact us with any questions.

Employment and Income Verification:

- Proven employment status of at least 2 years.

- Steady or increasing income over a 2 year period.

- Past two years completed tax returns.

- Past two years W-2's, 1099's and any other necessary tax forms.

- One month worth of newest pay stubs.

- Self-employed will need three years tax returns and YTD Profit & Loss Statement.

Credit History:

- History of on-time payment. No more than two missed payments on your credit.

- If you've filed for bankruptcy you must wait at least 2 years and have good credit since you filed.

- Those with foreclosures must wait at least 3 years since the most recent foreclosure.

Financial Obligations:

- Monthly mortgage payment should be roughly 30% of your gross income.

- You must pay a minimum of a 3.5% down-payment.

- Agree to 2.25% in closing costs.

- Past three months full bank statements for all accounts.

- Any recent statements from investment accounts (retirement, 401k, mutual funds, etc.).

Property Eligibility and Documentation:

- Only certain properties are eligible - single-family homes, condominiums, double-wide manufactured homes, modular homes and 2-4 unit properties.

- The property must be your primary residence.

- Driver's License or other official State identification. .

- Social Security Card.

- Any Divorce, Palimony, Alimony Documents.

- Green card or work-permit (if applicable)

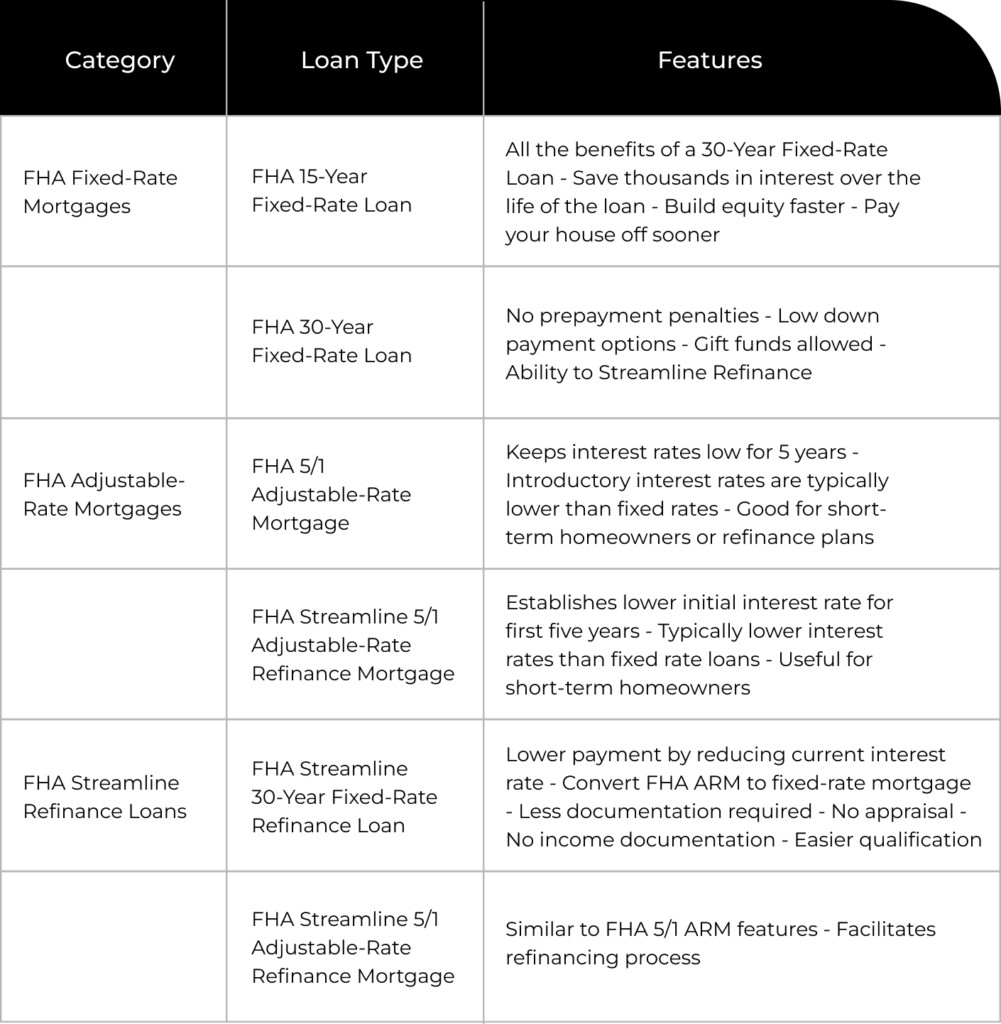

Types of FHA loans

FAQ

An FHA loan is a mortgage insured by the Federal Housing Administration. It is specifically designed for low-to-moderate-income borrowers.

A minimum credit score of 580 is required for an FHA loan with a 3.5% down payment.

Benefits include lower down payment requirements and more lenient credit score criteria.

No, there are no income limits for FHA loans, but the loan amount is capped.

Yes, through the FHA 203(k) program, you can finance both the purchase and renovation of a home.