USDA Loans

What are USDA Loans?

If you dream of a cozy rural home in America but worry about affording it, consider a USDA loan. These loans, backed by the United States Department of Agriculture, help people buy homes in eligible rural areas, promoting homeownership. Don’t think they’re just for farms; many properties in suburban areas near cities qualify too. Like FHA loans, USDA loans are government-backed, offering flexible terms like no down payment or income limits. Created in 1991, they aim to help low- and moderate-income buyers. You can use them to buy, build, or renovate homes. Loan limits vary by location, from half a million in pricey areas to around $100,000 in rural spots.

USDA Loan Benefits

- 100% Financing - you can buy a home with no money down. In some cases you can even finance your closing costs.

- You can refinance your home up to 100% of the value of your home.

- No monthly mortgage insurance premiums: You won't pay monthly insurance premiums with a VA loan.

- Low Fixed Rate Mortgage Options.

- They are usually easier to get because the Government insures the loan so that there is much less risk to the lender.

- They can be used for Existing Homes, Foreclosures or New Construction.

- Less than perfect credit usually accepted: You don't need perfect credit for a VA loan.

- Simple Loan Process.

- No Loan Limit. No Acreage Limit.

- There is No Prepayment Penalty.

- You can use the loan to repair or add on to your home.

- Flexible Credit Requirements.

What are the USDA Loan Requirements?

Credit Score and History:

- Credit score of 580 or higher preferred.

- Clean credit history with no accounts in collections in the last 12 months.

Property Eligibility:

- Property must be your primary residence.

- Must be located in an eligible area listed on USDA's interactive map.

Property Evaluation:

- Appraisal required to ensure accurate loan amount.

- Property must meet USDA standards including code compliance, working utilities, and no significant damages.

Borrower Eligibility:

- Must be a U.S. citizen, U.S. non-citizen national, or a Qualified Alien.

- Income must not exceed 115% of the median income of the area.

Income Verification:

- Proof of reliable income for at least 12 months.

Financial Capability:

- Ability to pay associated fees and costs including lender fees, guarantee fee, and closing costs.

- Monthly payments must not exceed 29%-32% of monthly income.

Loan Usage:

- Funds strictly for primary residence, not for investment or business purposes.

Lender's Requirements:

- Individual lenders may have additional criteria beyond USDA's requirements.

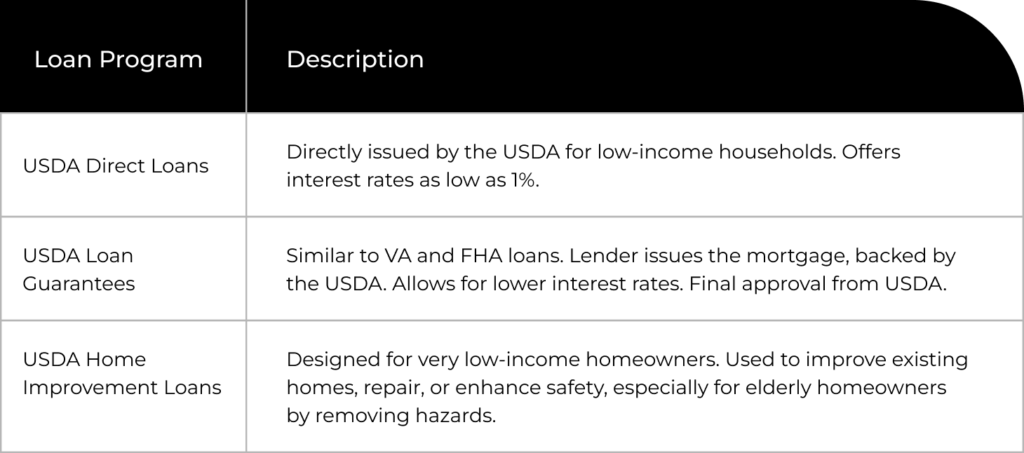

Types of USDA Loans

FAQ

A USDA loan is a mortgage backed by the U.S. Department of Agriculture. USDA Loan is specifically designed for rural homebuyers.

Property location in an eligible rural area. The borrower also needs to meet some income limits.

No down payment required, competitive interest rates, and lower mortgage insurance premiums.

Yes, as long as the area meets USDA’s rural development guidelines.

There is no set maximum loan amount; it depends on the borrower’s income and ability to repay.